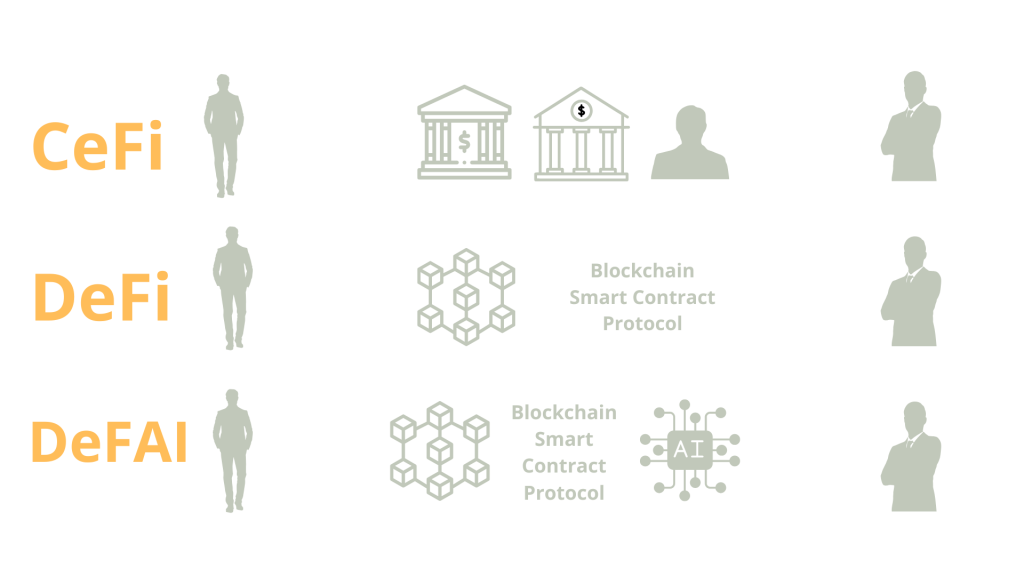

The convergence of Decentralized Finance (DeFi) and Artificial Intelligence (AI) has brought forth a new and exciting frontier in the blockchain space, DeFAI. This innovative fusion is aimed at enhancing the DeFi protocols’ capabilities with the help of AI and may potentially change the way people will use decentralized financial systems. While this field is still in its early stages, it is important for anyone, new to crypto or experienced, to know the basics of DeFAI, how it works, what it can do for us, and how it may affect the rest of the Web3 world. In this comprehensive guide, we will cover what DeFAI is, how it can be used in real-life scenarios, what projects are out there, and what opportunities and risks the future holds. If you are a beginner, looking to gain some understanding, or a veteran of blockchains, this article will help you gain an understanding of AI-powered decentralized finance.

Understanding the Basics of DeFAI

DeFAI represents the intersection of two groundbreaking technologies: decentralized finance and artificial intelligence. At its heart, DeFAI is meant to improve the functionality, accessibility, and efficiency of DeFi protocols by incorporating AI driven solutions. Some of these challenges include complex user interfaces, inefficient risk management, and limited personalization; all of which this synergy has the potential to address in the DeFi space.

One of the primary objectives of DeFAI is to make it easier to navigate the world of cryptocurrencies and ensure that this is easy for both the seasoned trader and the newcomer to use.

By leveraging AI technologies, DeFAI platforms can automate complex processes, provide personalized insights, and offer more intuitive user experiences.

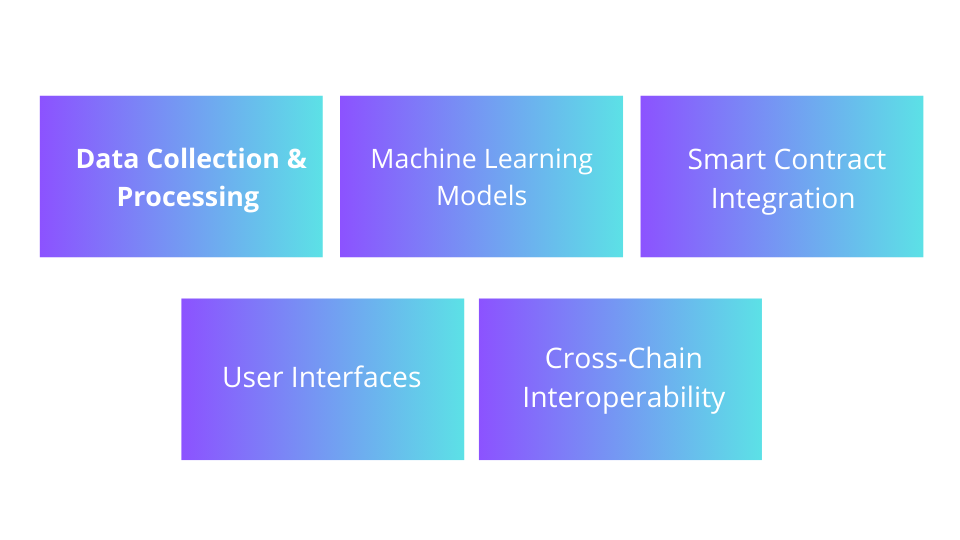

Some key features of DeFAI include:

The journey towards DeFAI began with the separate development of DeFi and AI technologies. DeFi has emerged as a revolutionary concept in the blockchain space, offering financial services, through smart contracts and decentralized applications (dApps) without intermediaries.

In the meantime, AI has been making significant strides in various industries and has proved itself as the technology capable of processing vast amounts of data, recognizing patterns and making intelligent decisions. It was a natural progression for these two technologies to converge as both fields have common goals of automation, efficiency and innovation.

Early experiments in combining DeFi and AI focused on simple tasks such as automated trading bots and basic market analysis tools. However, as AI capabilities advanced and DeFi protocols became more sophisticated, the potential for deeper integration became apparent.

Key milestones in the evolution of DeFAI include:

1. The development of AI-powered oracles for more accurate and reliable price feeds

2. Implementation of machine learning algorithms for optimizing liquidity provision and yield farming strategies

3. Creation of natural language processing (NLP) interfaces for executing complex DeFi operations

4. Integration of predictive analytics for risk management and portfolio optimization 5. The development of sovereign autonomous AI agents that are capable of executing multi-step DeFi strategies across multiple chains.

As the DeFAI ecosystem continues to evolve, we can expect to see even more innovative applications that push the boundaries of what’s possible in decentralized finance.

At its core, DeFAI operates by integrating AI algorithms and models into various components of DeFi protocols. This integration allows for more intelligent decision-making, automated processes, and enhanced user experiences.

Let’s break down the key technical aspects of how DeFAI functions:

Data Collection and Processing

DeFAI systems rely on vast amounts of data to make informed decisions. This data can come from various sources, including:

On-chain transaction data Smart contract interactions Market prices and trading volumes Social media sentiment analysis News and regulatory updates AI algorithms process this data in real-time, identifying patterns, trends, and potential opportunities or risks.

Machine Learning Models

DeFAI platforms employ various machine learning models, including:

These models are continuously trained and updated with new data to improve their accuracy and effectiveness.

Smart Contract Integration

AI models are integrated with smart contracts through oracles and other middleware solutions. This integration allows AI-driven decisions to be executed on-chain, ensuring transparency and immutability.

User Interfaces

DeFAI platforms often feature intuitive user interfaces that leverage natural language processing and other AI technologies. These interfaces allow users to interact with complex DeFi protocols using simple commands or even voice instructions.

Cross-Chain Interoperability

Many DeFAI solutions are designed to operate across multiple blockchain networks, optimizing for the best opportunities and efficiency. This cross-chain functionality is often facilitated by AI agents that can analyze and execute transactions across different protocols and networks.

By combining these technical components, DeFAI creates a more intelligent, efficient, and user-friendly ecosystem for decentralized finance.

DeFAI is finding applications across various aspects of the cryptocurrency and blockchain ecosystem.

Here are some of the most prominent use cases:

Portfolio Management and Automated Trading

Trading bots can analyze market conditions, execute trades, and manage portfolios without the need of a person.

Risk Assessment and Management

DeFAI platforms can provide more sophisticated risk assessment and management tools, including:

Personalized Financial Advice

By analyzing user behavior, market conditions, and historical data, DeFAI systems can offer personalized financial advice, such as:

Enhanced User Interfaces

DeFAI is revolutionizing how users interact with DeFi protocols through:

Natural language interfaces for executing complex DeFi operations Voice-activated commands for portfolio management and trading

Personalized dashboards that present relevant information based on user behavior Chatbots for customer support and guided tutorials

Cross-Chain Optimization

AI agents in DeFAI can optimize operations across multiple blockchain networks by:

Identifying the most efficient routes for cross-chain asset transfers

Automating the process of bridging assets between different networks Optimizing gas fees and transaction speeds across various chains

Aggregating liquidity from multiple DEXs across different networks

These applications demonstrate the vast potential of DeFAI to enhance and streamline various aspects of the cryptocurrency and blockchain ecosystem.

The DeFAI space is rapidly evolving, with new projects and platforms emerging to address various aspects of AI-powered decentralized finance. Here are some of the most notable projects in the ecosystem:

Orbit

Orbit focuses on multi-agent DeFi operations with cross-chain compatibility. Its AI agents are designed to handle a wide range of DeFi tasks, from simple token transfers to complex liquidity provision and yield farming strategies. Key features include:

Modular approach to DeFi automation

Specialized AI agents for different purposes (e.g., USDC transfer agent, LP agent, trade copying agent) Cross-chain functionality for seamless asset management

AIXBT

AIXBT is an AI-powered platform designed to provide real-time market insights to DeFi traders. It aggregates data from both on-chain and off-chain sources to offer actionable insights and help traders make informed decisions quickly. Notable features include:

Real-time sentiment tracking across social media platforms

AI-driven trading recommendations and risk assessments

Terminal application for deeper insights and personalized market analysis

HeyAnon

HeyAnon positions itself as a “super app” for DeFi automation, aiming to bridge the gap between casual users and advanced DeFi traders. Its flagship AI agent, Anon, serves as a personal assistant for navigating DeFi, capable of handling everything from token swaps and liquidity provision to staking and yield farming – all through simple text commands.

Bittensor

While not exclusively a DeFAI protocol, Bittensor has become one of the most significant projects at the intersection of AI and blockchain. It’s a decentralized network that incentivizes the development and distribution of machine learning models using cryptographic rewards. Bittensor’s potential to support AI agents specifically designed for DeFi tasks makes it a crucial player in the DeFAI ecosystem.

These projects represent just a fraction of the innovative work being done in the DeFAI space. As the field continues to evolve, we can expect to see even more groundbreaking platforms and applications emerge.

As DeFAI continues to evolve, several trends and potential developments are shaping its future trajectory:

DeFAI has the potential of closing the gap between decentralized and traditional finance. We may see: AI driven platforms that integrate seamlessly with traditional banking systems, DeFi protocols. Hybrid financial products that combine the best of both traditional and decentralized finance. Automated compliance and reporting tools that enable institutions to engage with DeFi without a hitch.

The next generation of DeFAI platforms may offer more sophisticated predictive capabilities:

AI models that can forecast market trends and potential black swan events with higher accuracy Personalized risk assessment tools that adapt to individual user behavior and market conditions Automated strategy optimization based on complex multi-factor analysis

We may see the emergence of fully autonomous AI agents capable of:

Managing entire DeFi portfolios without human intervention

Executing complex, multi-step strategies across various protocols and chains Adapting to changing market conditions in real-time

AI can be used in a variety of ways to enhance the governance and decision making of DAO: Proposal analysis and impact assessment with the help of AI.

Automated consensus-building mechanisms

Predictive modeling for governance outcomes

The future of DeFAI may offer highly personalized user experiences:

AI-driven interfaces that adapt to individual user preferences and skill levels Customized financial products and services tailored to specific user needs Personalized education and onboarding experiences for new users

DeFAI is likely to play a crucial role in enhancing cross-chain functionality: AI-powered routing for optimal cross-chain transactions

Automated arbitrage and liquidity provision across multiple chains

Unified interfaces for managing assets across various blockchain networks

As these trends continue to develop, DeFAI has the potential to significantly change the landscape of decentralized finance and increase the adoption of blockchain technologies.

In this guide, we’ve illustrated how DeFAI is an intersection of two revolutionary fields: decentralized finance and artificial intelligence. This integration has the ability to solve most of the problems that are facing the current DeFi sector and create new opportunities for growth and development of power to users.

The integration of AI in decentralized finance aims at increasing accessibility, decision-making and the automation of processes. DeFAI has the potential of making blockchain based financial services easier to use and more efficient with simple and intuitive user interfaces and powerful risk management tools for both new and experienced users respectively. However, DeFAI is still in the very beginning. Just like any other developing technology, DeFAI has its weaknesses, which are scalability, security, and regulatory compliance. It is in the next few years that these challenges are likely to be solved and the DeFAI ecosystem will develop. For anybody planning to get involved in DeFAI, as a user, developer or an investor, it is advisable to tread this area with caution and excitement. Remain aware, begin with the small things and always secure yourself and your investments. DeFAI is still under development and has the potential to become an important part of the blockchain adoption and the financial systems renewal process. Therefore, DeFAI can be seen as a solution that will help to integrate the two worlds and make blockchain products available to the majority of people.

The evolution of DeFAI is only starting and its impact is still to be seen. In the next few years, it will be interesting to see how this area will grow and possibly change the face of finance and technology. Whether you are a casual observer or an active participant in the blockchain space, DeFAI is one space to look out for as it shapes the future of decentralized systems and AI.

If you’re looking to build or scale AI-powered DeFi products, check out ND Labs — we help startups and enterprises turn cutting-edge tech into working solutions.