Cryptocurrencies have moved from niche assets to a mainstream part of the global financial system. But owning digital money isn’t enough; you also need a safe and reliable way to store and use it. That’s where crypto wallets come in.

A crypto wallet is not just a storage tool. It’s your gateway to managing assets, accessing Web3 apps, trading in DeFi, and even interacting with NFTs. For businesses seeking to drive Defi wallet development, selecting the right solution is key for security and usability.

In this guide, we’ll break down what a crypto wallet is, why it matters, how it works, the different types available, and how to choose the right one for your needs.

A cryptocurrency wallet (or crypto wallet) is a digital tool that stores your private keys and gives you access to crypto assets on the blockchain.

Crypto wallets don’t hold coins directly but provide the interface to send, receive, and manage funds securely.

There are two main categories:

For individuals, a crypto wallet is the safest way to protect assets, verify ownership, and carry out transactions. It ensures privacy, helps manage balances, and provides access to Web3 platforms.

For businesses, wallets open new opportunities:

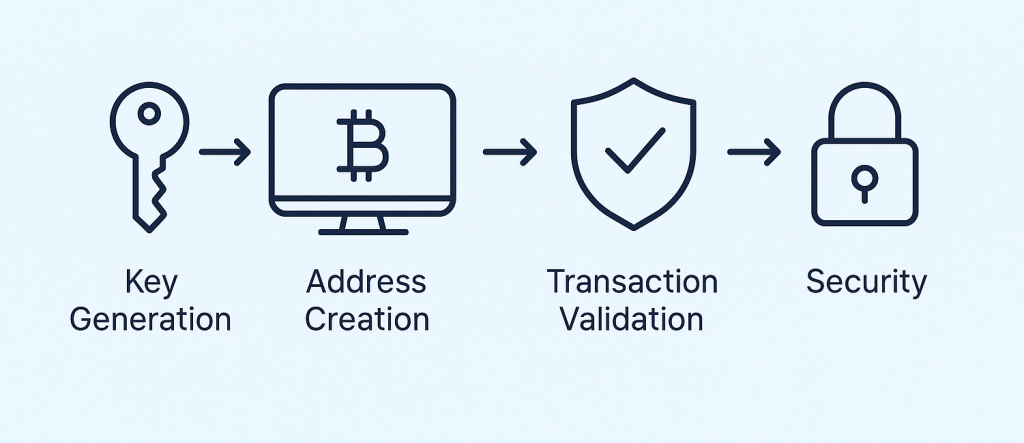

A crypto wallet doesn’t actually “store” coins. Instead, it manages cryptographic keys that unlock access to funds recorded on the blockchain. The process can be broken down into four steps:

For a deep dive into programmable smart-contract wallets, MPC, and policy engines, see Mastering Blockchain Wallets.

There are many categories of wallets. A full breakdown can be found in Types of Cryptocurrency Wallets. Here’s a quick overview:

When evaluating wallets, consider:

For a more detailed breakdown, check our guide – How to Choose the Right Blockchain Wallet

Many users ask: what’s the difference between a crypto wallet and an exchange account?

Although they both give access to cryptocurrencies, their core functions and security models are very different:

| Feature | Crypto Exchange | Crypto Wallet |

|---|---|---|

| Control of funds | Custodial – the exchange holds private keys | Non-custodial – user controls private keys |

| Purpose | Trading, buying/selling, fiat on-ramps | Secure storage, direct blockchain access |

| Accessibility | Always online, quick to trade | Depends on wallet type (hot = online, cold = offline) |

| Security risk | Exchange hacks, withdrawal freezes | User responsibility, risk of seed loss |

| Best for | Active traders, beginners who want easy access | Long-term holders, users who value self-custody |

In short: an exchange is like a bank, while a wallet is like a personal safe.

For maximum security, experts recommend using an exchange for trading but transferring assets into a wallet for long-term storage.

| Wallet | Type | Key features |

|---|---|---|

| Ledger Nano X | Hardware | Strong security, multichain support |

| Trezor Model T | Hardware | Touchscreen, dApp integration |

| Exodus | Desktop/Mobile | User-friendly, built-in exchange |

| MetaMask | Browser | Gateway to DeFi and Web3 |

| Trust Wallet | Mobile | NFT and staking support |

| Coinbase Wallet | Mobile | Exchange integration |

| Atomic Wallet | Multi-platform | Multi-currency, in-app swaps |

| Electrum | Desktop | Lightweight Bitcoin wallet |

| Edge | Mobile | Easy to use, cross-asset support |

| Guarda Wallet | Multi-platform | Non-custodial, staking features |

| BitPay | Mobile | Merchant payments with crypto |

Choosing between a white label and a custom wallet depends on your timeline, budget, and goals:

When to choose what:

An anonymous wallet allows transactions without identity verification (no KYC). These focus on privacy but may face regulatory restrictions.

An exchange stores funds online (custodial), while a wallet gives direct control of private keys (non-custodial).

A wallet address is a unique identifier (like a bank account number) for sending and receiving funds on the blockchain.

It’s a digital balance for traditional currencies (USD, EUR, etc.) that can be used alongside crypto inside the platform.

QFS often refers to the Quantum Financial System, a speculative concept sometimes mentioned in forums. It’s not part of mainstream crypto wallets.

A crypto wallet is more than just storage; it’s the foundation of digital finance. Whether for individuals managing assets or businesses expanding into Web3, the right wallet ensures security, usability, and growth opportunities.

ND Labs helps companies design and launch wallets, from white label solutions to fully custom products. Whether you want to go to market fast or build a wallet with advanced functionality, we deliver secure and scalable results.