Thinking about how to read NFT markets? Most NFT analytics tools’ posts stop at long catalogs, while the landscape itself is multi-chain, data is uneven across marketplaces, and headline numbers (like “floor”) often hide liquidity risk. This guide goes further: it explains which signals actually change decisions, where different tool types are strong or limited, and how to assemble a lean stack you can run every day without burning hours.

Comprehensive catalogs make it clear there isn’t one “best” tool; there are roles you need covered. Use catalogs to filter by chain and category, then pick one tool per role to keep your routine simple.

This is a quick reference, not a ranking. Open one tool per role to keep your routine simple.

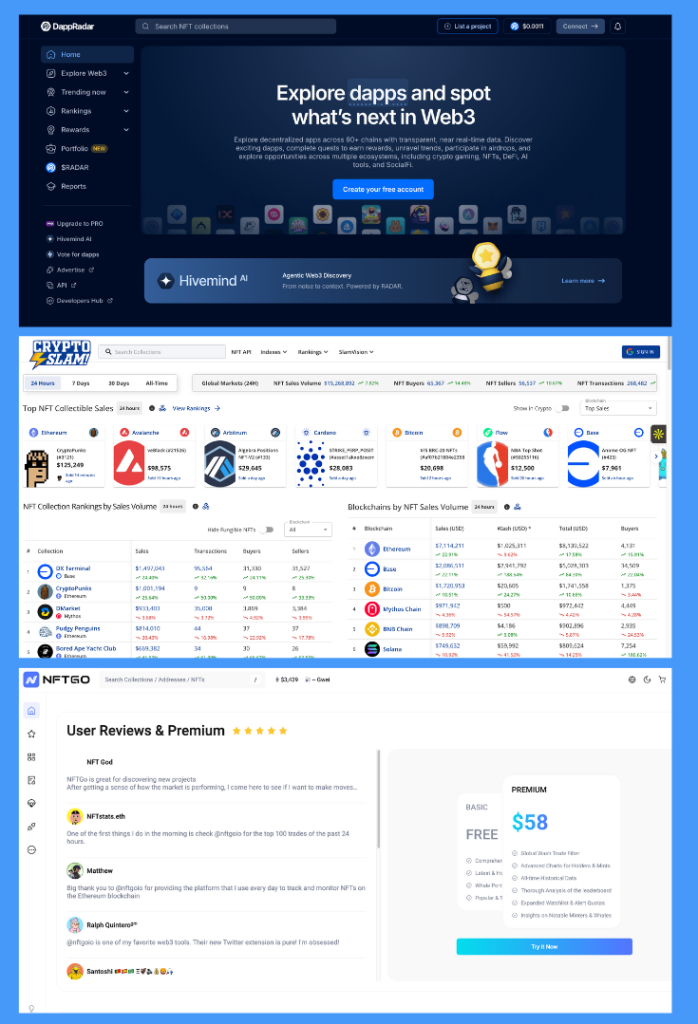

Market scanners (market overview)

NFTGo — 24h/7d leaders, trending collections, hot mints.

DappRadar — multi-chain rankings for dapps and collections.

CryptoSlam — cross-chain leaderboards and sales feeds.

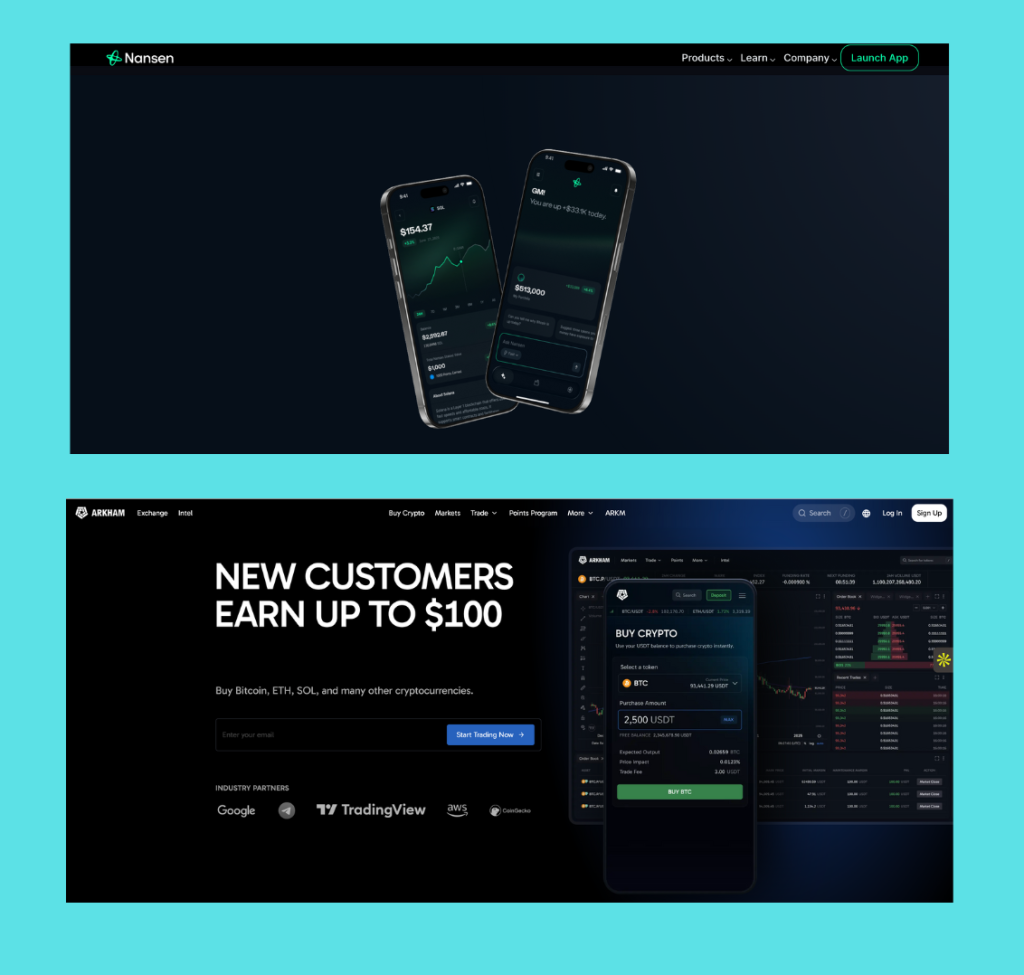

Wallet-aware / “whale tracker” (holder behavior)

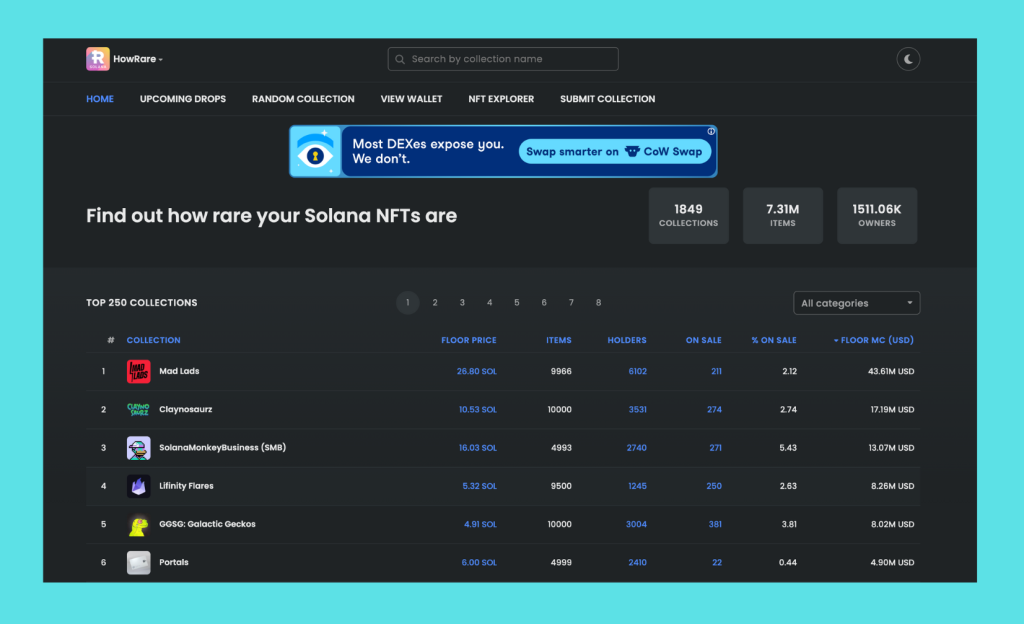

Rarity / traits (token-level context)

Rarity.tools — rarity ranks and trait filters.

Rarity Sniper / Trait Sniper — quick rarity checks during drops.

HowRare.is (Solana) — rarity and floor snapshots for SOL collections.

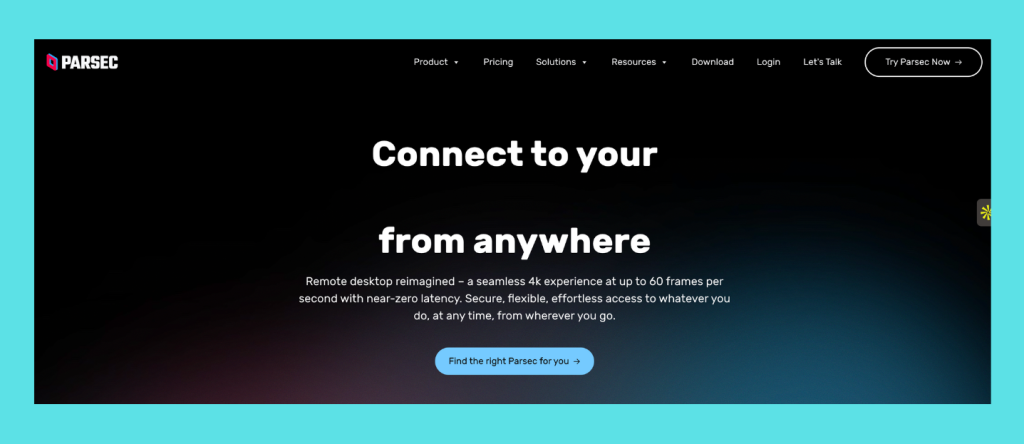

Real-time terminals / dashboards (timing & microstructure)

Parsec — live listings, charts, and order-flow style views.

Tensor / SolanaFloor (Solana) — floor and listing dynamics for SOL.

Explorers (on-chain verification — must-have)

Three questions sit behind every trade, launch, or brand campaign.

Demand. Don’t chase single-day spikes. Look at volume, sales count, and unique buyers over 7- and 30-day windows to separate impulse from trend. Market scanners and catalogs surface this layer through leaderboards and trending collections.

Ownership. Holder count is not enough. You also need concentration (how much sits in a few wallets), whether new addresses are arriving, and if cohorts retain after hype. Wallet-aware platforms that label addresses and expose holder breakdowns are designed for this due-diligence step—typical for an nft whale tracker.

Liquidity. Floor is a headline; liquidity is reality. Track nft floor price tracking with listing depth around floor, the churn of cancels/re-lists, and time-to-sell for new supply. That is where short-term risk (or safety) lives. Real-time/terminal-style nft dashboards call this out explicitly.

Every UI can lag or miss off-market changes. That is why on-chain verification is non-negotiable. Before you act, confirm the contract, events (mint/transfers), approvals, and holder trees in a blockchain explorer. It’s the only source of truth all serious guides agree on.

See also our field guide to NFT Security and common NFT Scams.

Most teams lose time switching tabs. Instead, run a five-step, repeatable flow:

Write your thesis in one or two lines and revisit it weekly. That discipline turns “noise” into a trail of decisions you can learn from.

What tools do well? Catalogs organize coverage by chain and help you jump straight into the right app pages; wallet analytics surface behavior you cannot infer from price alone; rarity services prevent overpaying for mid-tier pieces. Combined, they cut research time dramatically.

Where they fail. Indexing delays, incomplete marketplace coverage, imperfect wallet labels, and volume distortions from wash trading. To mitigate, triangulate between two independent sources and always finish with an explorer check—standard advice across professional explainers.

For launch and post-mint work, revisit NFT Collections and the marketplace playbook: What Is an NFT Marketplace.

Free tiers cover market scans, basic collection pages, NFT rarity tools, and on-chain verification. They don’t reliably cover real-time alerts, labeled flows at scale, or multi-chain depth. When your work moves from “watching” to “operating,” paid capacity earns its keep.

What are the best NFT analytics tools for traders vs. brands?

Traders: scanners + real-time NFT dashboards + wallet labels + explorer. Brands: multi-chain coverage, cohorts/retention, and product KPIs.

How to set up NFT floor price tracking correctly?

Track floor with listing depth and cancellation/relist churn, not the headline price alone; validate anomalies in a blockchain explorer.

Which metrics matter most for NFT collections?

Liquidity & listings, holders growth and concentration, time-to-sell, plus volume, sales, unique buyers, and rarity context.