Passwords remain one of the weakest points in digital security today! Despite decades of use, they are increasingly ineffective in the face of modern internet threats — data breaches, phishing attacks, password reuse, and weak protections. In the age of Web3 and decentralized identity (DID), a new tool is emerging that could transform the landscape: the identity wallet — a digital wallet that manages your online identity.

Passwords were never meant to be a long-term solution. Today, they:

According to IBM and Verizon reports, over 80% of data breaches involve compromised credentials. That’s a call to action.

The average user today manages around 35 online accounts, often with poor password hygiene. A recent global survey revealed that 25% of users reuse the same password across 11 to 20+ accounts, and 36% include publicly available personal data in their passwords, data often easily found via social media or forums. A clear example of the consequences came in December 2023, when the 23andMe breach exposed the data of nearly 7 million users after hackers exploited leaked passwords.

Users also often struggle with the cognitive burden of managing complex passwords and navigating multi-factor authentication processes, leading to security fatigue and potentially dangerous shortcuts.

An identity wallet is a digital wallet that stores verifiable credentials, digitally signed pieces of information that prove identity.

These can include:

With an identity wallet built on decentralized identity systems, users gain:

A decentralized identity system combines several key components:

When accessing a service, instead of entering an email and password, your identity wallet provides a verifiable claim (e.g., age 18+). The service validates this without ever accessing your private data.

A digital identity wallet isn’t just a prettier login screen. Under the hood, it combines two different steps:

Many systems today invest heavily in verification, but treat ongoing authentication as an afterthought. To avoid account takeover and fraud, both layers must be designed together.

Moving from passwords to wallets solves many problems, but doesn’t remove all risk. Typical threats include:

Strong wallet-based authentication usually combines:

The result is a login model that is harder to phish than passwords, but still familiar enough for users: tap, confirm, and you’re in.

The European Union is actively developing the EU Digital Identity Wallet, which allows citizens to:

This initiative was launched by the European Commission in 2021 as part of the eIDAS 2.0 regulation. The goal is to make the wallet available to all EU citizens by 2026, recognized across all member states. The wallet will meet strict privacy standards, support mobile devices, and serve as a universal tool for authentication, document signing, qualification verification, and more.

It’s the first large-scale decentralized identity implementation at the national level, focusing on privacy, interoperability, and user control.

The EU’s approach combines strong legal guarantees with modern decentralized identity tooling and strict privacy requirements. We break down the privacy side in more detail in our article on privacy in decentralized identity.

Around the world, digital identity wallets are moving from pilots to everyday tools.

The direction is clear: identity wallets are becoming a core part of national and regional digital infrastructure, not just a niche experiment.

Governments are approaching decentralized identity adoption in different ways, balancing innovation, trust, and regulation:

European Union (eIDAS 2.0) – Combines decentralized identity systems with legal trust services. The EU aims to roll out interoperable, privacy-focused Digital Identity Wallets (EUDI Wallets) by 2026. The eIDAS 2.0 framework blends self-sovereign identity (SSI) principles with legally recognized trust frameworks, involving qualified issuers and service providers. It emphasizes selective disclosure and legal validity across borders.

United States – The U.S. ecosystem is market-driven and led by tech companies like Microsoft, IBM, and Oracle. It is innovation-focused with rapid adoption but lacks unified federal regulation, which results in challenges around standardization and interoperability.

Japan — Follows a hybrid approach that incorporates blockchain and decentralized identities as part of its digital transformation strategy. The government encourages adoption in healthcare, finance, and public services, focusing on security and standardization while maintaining flexible legal frameworks.

The eIDAS 2.0 framework blends decentralized identity with self-sovereign identity principles. If you’re comparing these models, our guide on decentralized identity vs self-sovereign identity explains the differences in more detail.

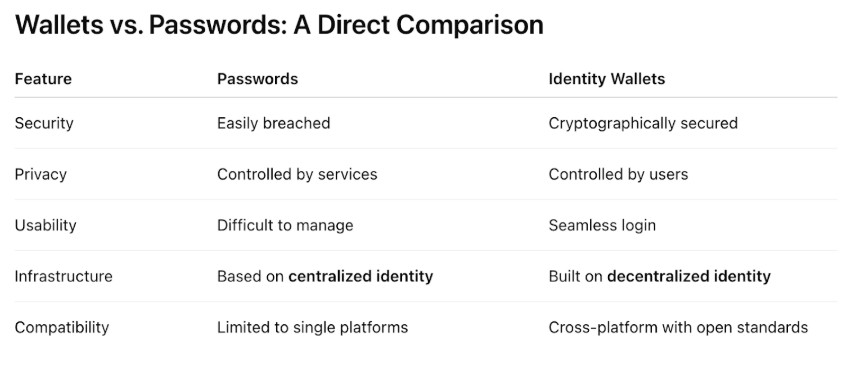

Security. Passwords are prone to phishing and leaks, whereas identity wallets use cryptography and never expose your data to the service.

Convenience. Users no longer need to remember dozens of credentials—one wallet grants access to all platforms.

Privacy. Centralized systems collect and store your personal data; identity wallets let you decide what to share and with whom.

Control. Password systems are controlled by service providers. Wallets offer complete control to the user.

Scalability. Passwords struggle in multi-service ecosystems. Identity wallets work across platforms with high compatibility.

1) Microsoft Entra Verified ID

A corporate platform by Microsoft for issuing and verifying verifiable credentials of employees, students, and clients. Built on open DID and VC standards, it integrates with enterprise systems and identity access management. Suitable for HR, education, public services, and B2B ecosystems.

2) Spruce ID

A Web3-native identity solution allowing users to sign in and approve actions using wallets instead of passwords. Popular in DAOs, DeFi, and NFT platforms.

3) Polygon ID

Built on zk-SNARK technology, this decentralized identity framework enables privacy-preserving verification of identity and user rights. It is designed for scalable Web3 applications within the Polygon ecosystem.

4) Dock, Disco, ION (Bitcoin)

These projects build infrastructure and standards for verifiable credentials and DID:

Web3 projects – Already pioneering the shift to decentralized identity. Most decentralized apps now support wallet login and DID. It’s a natural evolution based on self-sovereign identity.

Fintech startups – within 1–3 years. Seeking to streamline KYC via identity verification using wallets. These companies aim to reduce KYC costs and boost security. Identity wallets automate onboarding and cut fraud risk.

EU public services – Mandated to adopt decentralized identities by 2026. eIDAS 2.0 mandates member states to adopt digital identity wallets. Citizens will use them to access state services.

Education and HR – within 3–5 years. Diplomas, certificates, and experience can be shared as verifiable credentials. This will streamline job applications and background checks.

Traditional SaaS – Slower adoption due to reliance on centralized identity models. Most legacy SaaS rely on LDAP, SSO, or centralized login systems. Migration will require architectural shifts and clear user demand.

This is known as passwordless login and is already being implemented across Web3 apps, financial platforms, and government systems.

An identity wallet isn’t just an app, it’s a secure architecture for managing identity:

Robust wallet support:

For a deeper industry-by-industry overview, see our top decentralized identity use cases.

Security. Biometrics often rely on cloud systems, introducing breach risks. Identity wallets use cryptography and local control.

Convenience. Biometrics are device-specific; wallets are cross-platform and Web3-native.

Privacy. Biometrics share data with services. Wallets allow selective disclosure.

Control. Biometrics are controlled by device manufacturers or third parties. Wallets are user-owned.

Compatibility. Biometrics are hardware-dependent. Wallets are becoming the standard across Web3.

For most teams, the question isn’t “wallet or passwords?” but how to phase in wallet-based login without breaking everything. A typical architecture includes:

At ND Labs, we usually help clients prototype wallet-based login on one or two key flows, measure impact, and then scale it across their ecosystem.

Before diving into technical standards, it’s helpful to explore how leading companies implement decentralized identity solutions.

For product and security teams, the goal isn’t to rip out passwords overnight. It’s to reduce their role over time and shift trust to:

– device-bound keys and identity wallets,

– reusable verified credentials instead of raw documents,

– UX that feels as simple as “tap to log in”,

– and architectures that are ready for EU digital identity wallets and national schemes.

Before diving into technical standards, it’s helpful to look at how real products implement decentralized identity today. At ND Labs, we design and build custom and white-label identity wallets, DID integrations, and verifiable credential flows that fit your tech stack and regulatory requirements.

What happens if I lose my device?

Wallets often support social recovery or backup keys.

Are identity wallets safer than passwords?

Yes, if built on trusted decentralized identity systems.

Can I use the same wallet across borders?

Yes, thanks to global decentralized identity standards.

Are wallets only for crypto?

No, they’re widely used in Web2, government, and education sectors.

Passwords won’t disappear overnight, but identity wallets are clearly the next step. They make authentication smarter, faster, and more secure, and a decentralized identity gives you the rails to support that at scale.