Welcome to the world of Real World Assets (RWAs) and crypto tokenization. In this article, we will explore the concept of RWAs and their rapid growth in the blockchain industry. RWAs, also known as tokenized real-world assets, represent a trend that has gained significant attention from experts, institutional investors, and traditional financial services providers. We will delve into the reasons behind this surge of interest, the types of assets that can be tokenized, the process of RWA tokenization, and the benefits it offers.

So, let’s dive into this exciting aspect of the digital economy and discover how tokenization companies are revolutionizing the way we interact with traditional assets!

Real World Assets (RWAs) are tokenized representations of tangible and intangible assets. By creating digital tokens that track these assets, their value and other indicators can be determined and recorded on the blockchain. The RWA ecosystem encompasses various tokenization platforms and protocols that facilitate the digital tokenization and trading of these assets, effectively transforming them into digital assets.

According to DeFiLlama, as of July 2025, the total value locked (TVL) in RWA-related protocols has surpassed $5.1 billion, with over 40 active projects operating across networks such as Ethereum, Polygon, Base, and Optimism. The most prominent RWA protocols now include Ondo Finance, Centrifuge, Goldfinch, Maple, and Backed Finance.

Types of Assets Suitable for Tokenization

Tokenization can be applied to a wide range of assets, both tangible and intangible. Any asset that can be formalized and documented can potentially be tokenized. Let’s explore some examples of assets that are well-suited for digital asset tokenization:

Recent advances have expanded tokenization to musical royalties, carbon credits, renewable energy projects, and future revenue streams. The growth of agri-fintech is also driving interest in agricultural and regenerative finance assets, opening new markets for tokenized investments.

It’s important to note that the tokenization of assets is not limited to these examples. Any asset that can be formalized and coded has the potential to be tokenized, opening up new investment opportunities in the tokenized economy. This includes security tokens and various other financial products and investment products that can benefit from blockchain technology.

The tokenization process involves several stages, from formalizing the asset to the maintenance of the tokenized asset. Let’s break down the key stages of RWA tokenization:

The first stage of tokenization is the formalization of ownership rights and the determination of the asset’s economic value. This requires expert assessment, due diligence, and compliance with regulatory requirements. The asset must be evaluated and registered according to the relevant jurisdiction’s norms, ensuring proper asset valuation and regulatory compliance. This stage is crucial for establishing the foundation of the digital token’s value and may involve collateral management to ensure the security of the tokenized asset.

Once the asset is formalized in the traditional world, its information needs to be transferred to the tokenization blockchain. Smart contracts and tokens of various standards are used to represent the real-world asset. Developers create smart contracts that contain data about the underlying asset, upon which the RWA token will be issued. In some cases, third-party auditors are trusted to handle the information transfer, ensuring the integrity of the process. Smart contract audits are essential to verify the security and functionality of these digital representations. This stage also involves designing efficient settlement processes to facilitate smooth transactions of the tokenized assets.

The final stage involves the development and maintenance of the RWA ecosystem. This includes ensuring the accuracy of the information about the tokenized asset, maintaining liquidity pools, and facilitating trading and redemption. Tokenization platform providers play a crucial role in maintaining the infrastructure, making necessary changes to smart contracts, and ensuring legal compliance. Price oracles and experts are often involved to provide up-to-date quotes for the underlying asset, contributing to efficient price discovery and market liquidity. This stage requires significant technical knowledge to manage the complex interactions between the blockchain and the real-world assets.

Tokenizing real-world assets offers several advantages that attract both developers and investors. Let’s take a closer look at these tokenization benefits:

Tokenization allows for the integration of traditional assets into the decentralized finance (DeFi) infrastructure. This increases accessibility and efficiency in trading by leveraging automated market makers and other blockchain solutions. RWAs serve as a bridge between traditional financial services and decentralized finance, transforming the landscape of the crypto market and providing new sources of capital, liquidity, and profitability. This integration also opens up opportunities for yield farming and staking rewards, enhancing the potential return on investment for token holders and creating new revenue streams for investors.

Platforms like Ondo and Maple now offer staking of tokenized U.S. Treasuries, giving DeFi users access to real-world yields with blockchain-native infrastructure. These products tap into decentralized money markets and liquidity pools across Base and Ethereum.

Tokenization provides access to traditional assets for a broader range of investors, including retail investors. Fractional ownership breaks down barriers, allowing smaller investors to enter markets that were once exclusive to the wealthy. This democratization of market access can lead to increased diversification and potential returns for investors, promoting financial inclusion and improving financial literacy among a wider audience.

Tokenization blockchain technology brings transparency and security to the tokenization process. The immutable nature of the distributed ledger ensures that ownership rights are securely recorded and cannot be tampered with. Smart contracts automate the execution of agreements, reducing the need for intermediaries and minimizing security risks. Additionally, the use of digital wallets and robust access controls, such as private keys, further enhances the security of tokenized assets. Tokenization companies often implement incident response protocols to address any potential security breaches or technical issues promptly.

The rise of real-time RWAs—where asset data (such as bond yields or inventory levels) is continuously updated on-chain—enhances trust and transparency. This is enabled through price oracles and on-chain monitoring protocols, which reduce the information gap for investors.

Tokenization enhances the liquidity of traditionally illiquid assets. By fractionalizing ownership and enabling trading on blockchain networks and trading platforms, investors have the flexibility to buy and sell tokens based on their investment strategies. This increased asset liquidity opens up new opportunities for investors and promotes market efficiency, potentially reducing liquidity risks. The ability to engage in 24/7 trading further enhances liquidity and market accessibility, allowing investors to react quickly to market changes and capitalize on global opportunities.

Tokenization provides opportunities for diversification by offering access to a wide range of assets. Investors can allocate their portfolios across different tokenized assets, reducing investment risks and potentially increasing returns. Depending on their risk appetite and investment goals, investors diversify either within a single tokenization platform or across multiple ones.

By leveraging blockchain technology, tokenization can significantly reduce transaction fees associated with traditional asset transfers. The automation of processes through smart contracts and the elimination of intermediaries can lead to more efficient and cost-effective transactions, benefiting both issuers and investors. This reduction in transaction costs can lead to improved resource allocation, allowing investors to maximize their returns.

Tokenization platforms often prioritize user experience, making it easier for investors to manage their digital assets. With intuitive interfaces and streamlined processes, investors can easily buy, sell, and monitor their Real World Assets tokenization, enhancing overall engagement and satisfaction.

The popularity of tokenization has been steadily increasing, driven by several factors. Let’s explore some of the reasons behind the rise of tokenization:

The cryptocurrency market has experienced a prolonged bearish trend, accompanied by a decline in trading volumes on decentralized exchanges (DEX). As a result, there has been an outflow of funds from DeFi, and the market capitalization of stablecoins has decreased. To counter these challenges, DeFi protocols are seeking new sources of liquidity, and RWA integration provides a potential solution. The tokenization of real-world assets can help mitigate market volatility by providing more stable, asset-backed investments.

DeFi protocols increasingly rely on RWAs to restore TVL and market participation. Asset-backed tokens are becoming popular for stablecoin alternatives, especially during prolonged crypto market downturns.

Traditional financial instruments, such as US Treasury bonds, have become more attractive due to higher yields. The Federal Reserve’s strategy to combat post-pandemic inflation by raising key interest rates has led to increased annual yields on these assets, reaching the highest levels in the past 15 years. Compared to stablecoins in the top-20 liquidity pools, only MakerDAO and Just Land offer comparable yields. Unlike US Treasury bonds, which the US government backs and regulates transparently, stablecoin and cryptocurrency investments expose investors to higher market risks.

Reflecting a shift toward decentralization and transparency, the adoption of blockchain technology in the banking and financial sectors has been gaining momentum in recent years. Swift, a global provider of financial messaging services, tested the transfer of tokenized assets between blockchains. Visa developed a solution for fee settlement in fiat currencies using blockchain technology. PayPal launched its own stablecoin. Blockchain platforms like Stellar and R3 Corda are becoming the technical foundation for tokenizing securities and central bank digital currencies (CBDCs) and facilitating cross-border transactions. This integration of blockchain with existing payment systems is creating powerful network effects, driving further adoption and innovation in the tokenization space.

The RWA ecosystem encompasses various categories of projects, each serving a specific purpose within the tokenization landscape. Let’s explore the main categories of projects in the RWA ecosystem:

Infrastructure projects form the technological foundation for asset issuance and compliance. They include specialized blockchains, technical stacks, and legal structures that enable the tokenization of assets. These projects provide the necessary tools and infrastructure to facilitate the issuance, trading, and compliance of tokenized assets, ensuring operational efficiency and regulatory compliance.

In essence, asset providers function as tokenization platforms, driving the digitization of real-world assets and building the systems for their ongoing support and allocation. Providers classify themselves according to the asset types they offer. The largest sectors in the market include real estate, lending, public debt, and more. Platforms specializing in real estate tokenization enable the trading of ownership rights and allow investors to earn rental income. Lending platforms provide loans backed by tokenized assets, and public debt platforms offer access to government bonds. These are just a few examples of the many asset providers in the RWA ecosystem.

Physical asset tokenization covers a wide range of assets, such as agriculture, regenerative finance, insurance-linked securities, various financial instruments, and physical commodities. Tokenizing physical assets allows investors to participate in these sectors and benefit from their potential returns while also considering environmental impact and social impact.

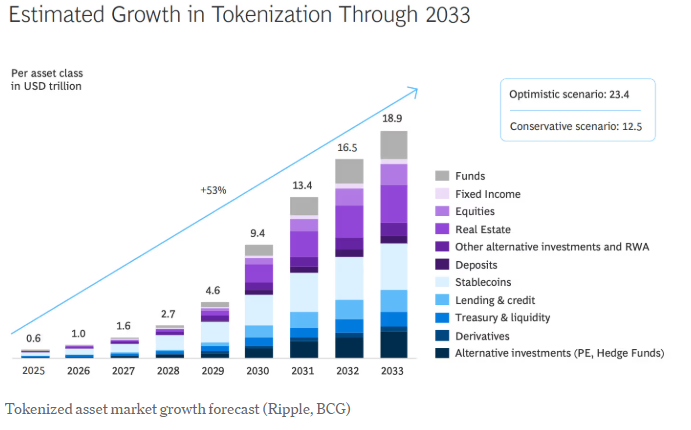

The future of tokenization looks promising, with projections indicating substantial growth in the RWA market. According to the Boston Consulting Group, the total capitalization of RWAs could reach 18.9 trillion dollars by 2033. This includes tokenized stocks, government bonds, real estate, and investment fund assets. The ongoing development and adoption of blockchain technology, along with the demand for new asset classes, are driving the popularity and expansion of tokenization.

As the tokenization industry matures, we can expect to see increased focus on regulatory compliance and the development of standardized frameworks for tokenized securities. This will help address regulatory risks and provide clearer guidelines for tokenization companies and investors alike. Additionally, the integration of tokenized assets with emerging markets could open up new opportunities for global investment and economic growth.

To support this growth, tokenization companies are likely to invest in comprehensive training programs to ensure that their teams have the necessary technical knowledge and regulatory expertise. These programs will be crucial in maintaining the industry’s high standards and adapting to evolving securities regulations.

As long as the tokenized economy matures, taxation, cross-border compliance, and secondary market risks become more prominent. Tokenization companies must now adopt standardized reporting practices and enhance internal risk management and cybersecurity protocols to meet institutional-grade requirements.

Conclusion

Tokenizing real-world assets opens up a world of possibilities for investors and developers alike. Integrating traditional assets into DeFi, improving accessibility, transparency, and liquidity are just a few of the many benefits tokenization offers.

As the RWA ecosystem matures, we can expect broader asset coverage and deeper integration with traditional finance. The tokenized economy presents new opportunities—but also demands careful risk assessment and regulatory awareness.

The tokenization industry uses blockchain technology, tackles compliance and security challenges, and actively reshapes financial markets while expanding global inclusion.

Ready to Tokenize Real-World Assets? Contact our team to discuss your project and bring your RWA vision to life.