Crypto wallets are no longer simple storage tools for Bitcoin or Ethereum. They have become gateways to the digital economy, enabling payments, investment, governance, and digital identity.

This guide explores the types of crypto wallets available in 2026 and what makes each suitable for different use cases. Whether you are a retail investor, an active DeFi participant, or a business seeking enterprise-grade custody, understanding wallet types is essential for navigating the future of digital finance.

For businesses building a DeFi wallet (DEX, staking, lending), take a look at our DeFi wallet development page.

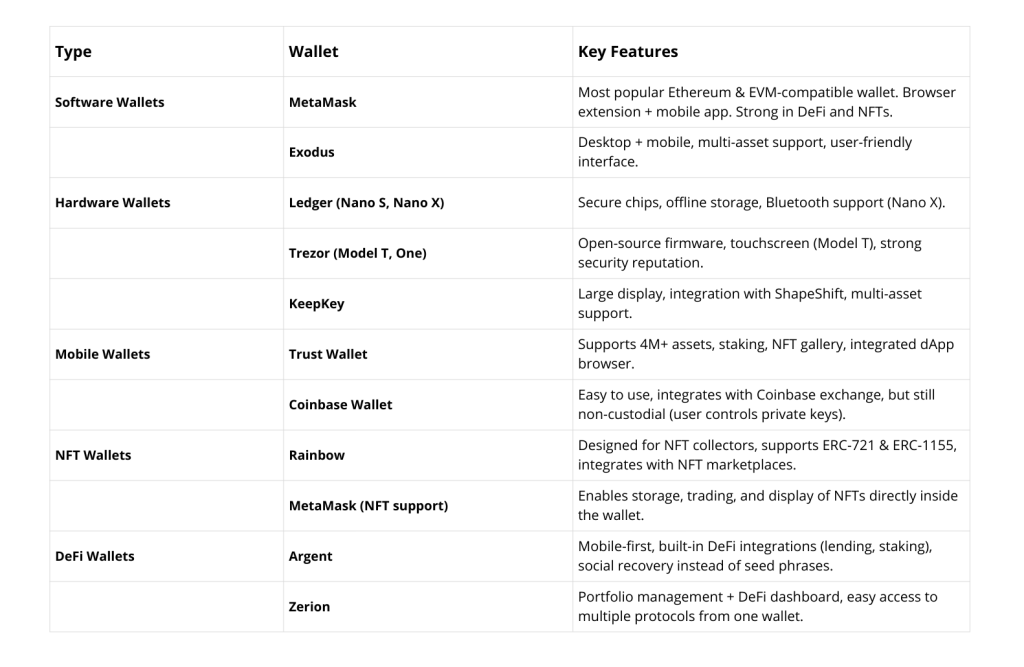

Traditionally, crypto wallets are divided into five broad categories:

This is the baseline classification most newcomers encounter. However, the ecosystem has evolved. In 2026, wallets are also defined by:

If you are completely new to wallets, start with our beginner’s guide: What is a Crypto Wallet

Software wallets are digital applications that run on desktops, smartphones, or browsers. They store private keys in software form and require internet access to operate.

Software wallets are convenient and versatile, but they are hot wallets — always online and therefore more exposed to attacks. They are best suited for active users, not for long-term cold storage.

Hardware wallets are physical devices (similar to USB sticks) that store private keys offline. They are considered the gold standard for security.

For a detailed explanation of offline security, see our dedicated article: What is a Cold Wallet.

Hardware wallets combine strong security with relatively simple usability, making them a top choice for serious investors.

Mobile wallets are easy to use, even for beginners. Mobile wallets run as apps on smartphones. They are designed for convenience and mass adoption. They help you manage your digital assets, trade, or just store your coins. Apps like Coinbase Wallet and Trust Wallet are very popular and are ranked among the top 5 apps for 2026. They let users check their crypto anytime, anywhere. They also offer top-notch security with biometric authentication and safe transactions.

Mobile wallets strike a balance: they’re more secure than web wallets but less secure than hardware wallets. Their growth reflects how crypto is moving toward daily financial utility.

This is one of the most important distinctions.

Users hold their own private keys.

Examples: MetaMask, Trust Wallet, hardware wallets.

Pros: full control, direct access to DeFi and dApps.

Cons: no recovery if keys/seed phrase are lost.

Learn more in our guide: What is a Non-Custodial Wallet.

For businesses, the choice often depends on requirements. Companies that want a faster launch without compromising security can explore ND Labs’ White Label Non-Custodial Crypto Wallet — a ready-to-deploy solution with proven features and enterprise-grade reliability.

As portfolios diversify, investors face a choice: one wallet for everything, or specialized wallets for each asset.

| Feature | Multi-Currency Wallets | Single-Currency Wallets |

|---|---|---|

| Assets Supported | Multiple blockchains (BTC, ETH, BNB, etc.) | One blockchain (e.g., Ethereum-only) |

| Convenience | High – manage all assets in one app | Low – need multiple wallets |

| Security | More complex, broader attack surface | Focused security for one network |

| Example | Exodus, Trust Wallet | MyEtherWallet (Ethereum) |

Multi-currency wallets are ideal for retail investors who want simplicity. Single-currency wallets are valuable for developers, DeFi users, or businesses focusing on a specific chain.

DeFi wallets are built specifically for decentralized finance. Unlike general-purpose wallets, they offer:

DeFi wallets have become essential for users seeking to maximize yield and interact with Web3 protocols.

NFT wallets are optimized for storing and trading non-fungible tokens. They support token standards like ERC-721 and ERC-1155.

NFT wallets are not just about storage — they are cultural hubs for the digital art and gaming economy.

There is no single “best” crypto wallet. The right choice depends on who you are and what you need:

Wallets are evolving from storage solutions into gateways to digital identity, governance, and finance. By understanding the different wallet types — and by choosing carefully — both individuals and organizations can position themselves securely in the Web3 economy.

For businesses seeking a strategic edge, ND Labs can help design or build custom wallet solutions that combine security, usability, and innovation.