Cryptocurrency markets move at lightning speed, with prices shifting in seconds and opportunities appearing just as quickly. For traders, keeping up with this pace manually can be overwhelming. This is where a cryptocurrency trading bot becomes a game-changer. By automating trades based on algorithms and data-driven strategies, trading bots allow investors to act faster, eliminate emotional decision-making, and potentially capture profits around the clock.

In 2025, as the market matures and competition increases, automated solutions are no longer just tools for professionals—they are becoming essential for beginners and experienced traders alike. From simple arbitrage bots that exploit price differences across exchanges to advanced AI crypto trading bots capable of learning and adapting in real time, the range of options continues to grow.

This expert guide explores everything you need to know about cryptocurrency trading bots: how they work, their advantages and risks, the best platforms available today, and what the future of automated crypto trading looks like. Whether you are a newcomer curious about the best crypto trading bot for beginners or an experienced trader searching for advanced trading bot strategies, this article will help you navigate the landscape with confidence.

A cryptocurrency trading bot is a software program designed to execute trades automatically on behalf of a trader. Unlike manual trading, where individuals make decisions based on charts and news, a bot follows predefined algorithms and market signals to buy or sell digital assets.

The main advantage is consistency – bots don’t experience emotions like fear or greed, which often sabotage human traders. Instead, they rely on data-driven trading strategies that can run 24/7.

Automated trading first gained traction on Wall Street decades ago with algorithmic systems designed for stocks and futures. As the crypto market emerged, developers quickly adapted these concepts to digital assets.

As the cryptocurrency market becomes more competitive and fast-moving, traders are increasingly turning to automation. A cryptocurrency trading bot can execute trades faster, more efficiently, and with greater consistency than any human. However, not all bots are built the same. Each category of bot is designed to follow a different strategy, offering unique benefits and risks.

The four most common types of crypto trading bots are:

Arbitrage bots are designed to exploit small price differences for the same cryptocurrency across different exchanges. Since digital asset markets are fragmented, Bitcoin or Ethereum can often be priced slightly differently on platforms such as Binance, Kraken, or Coinbase.

How they work:

Key points:

Risks: Exchange delays, API lags, or high fees can reduce profitability. Competition from institutional bots also makes this strategy challenging.

Trend-following bots rely on technical indicators to identify market momentum and enter trades when a strong trend is detected.

How they work:

Key points:

Risks: These bots struggle in sideways or choppy markets and may produce false signals. They also require careful backtesting to confirm their effectiveness.

Market-making bots aim to provide liquidity by continuously placing both buy and sell orders around the current market price.

How they work:

Key points:

Risks: Market-making bots face “inventory risk” if the market moves sharply in one direction; they may be left holding assets at a loss. Significant capital is also required for this approach to be effective.

AI crypto trading bots represent the most advanced type of automation, using artificial intelligence and machine learning to adapt strategies in real time.

How they work:

Key points:

Risks: These bots are expensive to develop and require reliable datasets. Despite their intelligence, they are not immune to sudden market crashes or unpredictable events.

At its core, a crypto trading bot consists of three elements:

Example: A simple bot can be coded to buy Ethereum when RSI drops below 30 (oversold) and sell when RSI exceeds 70 (overbought).

Automated cryptocurrency trading refers to the broader concept of using software systems to execute trades without constant human involvement. Instead of manually opening and closing positions, traders rely on programs that monitor markets, analyze data, and place orders automatically according to predefined rules.

The key idea is simple: automation removes delays, uncertainty, and emotions from decision-making, allowing for faster and more disciplined trading. While this concept is most often associated with a cryptocurrency trading bot, automation can also take other forms such as smart contracts in decentralized finance (DeFi) or algorithmic strategies deployed on institutional platforms.

Most platforms today use API connections (application programming interfaces) to link a trader’s exchange account with the trading software. Through this connection, the bot or system can open and close positions on behalf of the user, strictly following preset conditions.

At the cutting edge, some automated strategies already operate directly on blockchains through smart contracts, which eliminates the need for intermediaries and enhances transparency. This trend is expected to grow as DeFi ecosystems mature.

Compared to manual trading, automated systems offer several advantages:

Automation can be applied in different ways, depending on goals and complexity:

Most automated systems—whether simple bots or advanced AI solutions—operate through four main stages:

Takeaway: Automated trading is powerful, but it’s not a magic solution. A cryptocurrency trading bot should be treated as a tool that complements, not replaces, strategic thinking and proper risk management.

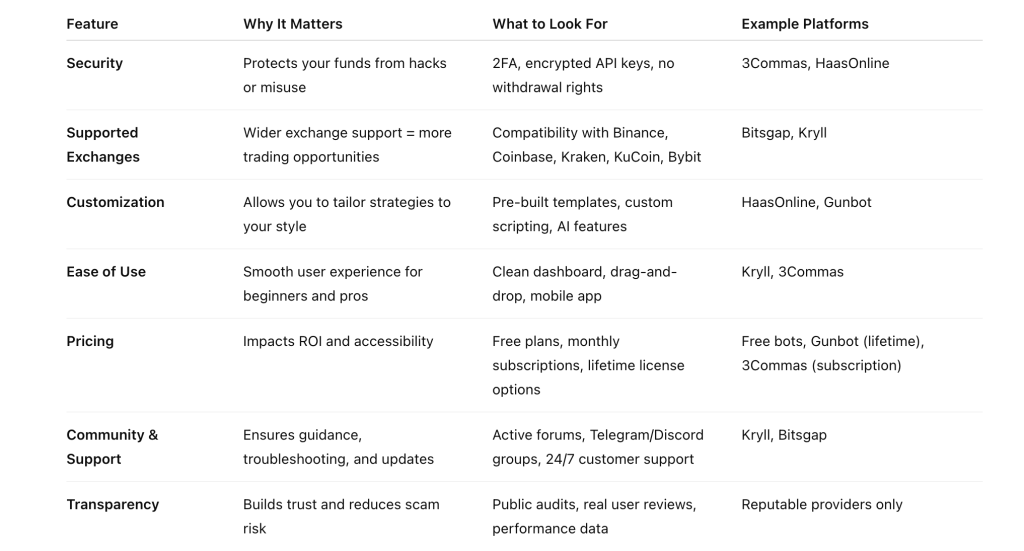

With dozens of platforms available, choosing the right cryptocurrency trading bot can be overwhelming. The decision depends on your trading goals, level of experience, and budget. Below are the key factors to consider when evaluating different options.

Security should always come first. Since bots connect to your exchange accounts via API keys, a breach could compromise your funds.

Tip: Avoid bots that require direct withdrawal permissions. A safe bot only needs trading rights, not access to move your funds.

A good trading bot should integrate smoothly with major exchanges such as Binance, Coinbase, Kraken, KuCoin, or Bybit. The wider the exchange support, the more opportunities you can capture.

Not all bots are equally flexible. Beginners may prefer ready-made templates, while advanced traders often need full customization.

If you’re experimenting with different trading bot strategies, choose a bot that allows backtesting and paper trading before going live.

A well-designed dashboard makes a big difference.

Bots come in both free and paid versions:

Always weigh the cost against the potential value the bot brings to your strategy.

A strong community means better resources, strategy sharing, and troubleshooting.

The crypto industry has its share of scams. To stay safe:

Summary: The best crypto trading bot for beginners is usually one that balances ease of use, affordability, and security—such as 3Commas or Kryll. Advanced traders may prefer platforms with deeper customization, like HaasOnline or Bitsgap. For those looking ahead, AI-powered bots offer exciting possibilities but require caution and careful testing.

Here’s an overview of the best crypto bots 2025:

| Platform | Key Features | Pricing | Best For |

|---|---|---|---|

| 3Commas | Smart trading, copy trading | From $29/mo | Beginners & copy traders |

| HaasOnline | Advanced strategies, backtesting | From $49/mo | Professional traders |

| Gunbot | Lifetime license, 100+ strategies | One-time fee | Technical traders |

| Kryll | Drag-and-drop strategy builder | Pay-as-you-go | Beginners, no coding skills required |

| Bitsgap | Grid bots, arbitrage opportunities | From $23/mo | Arbitrage & portfolio management |

Each bot offers unique strengths. For beginners, 3Commas and Kryll are often recommended as the best crypto trading bots for beginners, while advanced traders prefer HaasOnline or Gunbot.

Not every trader wants to rely on pre-built platforms. For those with technical expertise—or businesses looking to innovate—building a custom crypto trading bot can provide full control over strategies, architecture, and integrations.

Building a trading bot requires knowledge of programming languages like Python, Node.js, or C++, as well as experience working with exchange APIs (such as Binance, Coinbase, or Kraken). Key components include:

Frameworks such as CCXT, Backtrader, and TensorFlow are commonly used in bot development.

A developer may build a crypto arbitrage bot that tracks BTC/USDT prices across five exchanges simultaneously. If it detects a spread larger than 0.5%, the bot automatically executes buy and sell orders, locking in a profit.

While some traders prefer to code from scratch, many businesses collaborate with specialized firms to accelerate the process. For instance, working with a Crypto Trading Bot Development Company ensures that the bot is functional, secure, scalable, and tailored to specific business goals.

Such companies bring expertise in:

Always consult local regulations before deploying bots. It is also highly recommended to seek a consultation from blockchain experts to ensure compliance and reduce potential risks.

The coming years will mark a transformative era for AI crypto trading bots. By 2030, automation in digital asset markets will be far more advanced than the rule-based bots we see today. Instead of relying solely on fixed technical strategies, trading bots will increasingly function as hybrid systems, blending traditional quantitative models with real-time learning capabilities.

Businesses exploring AI-driven automation may benefit from partnering with an AI development services provider to create advanced, custom trading solutions.

Conventional bots excel at executing predefined algorithms such as arbitrage or grid trading, but they lack flexibility when markets behave unpredictably. Future AI-driven bots will merge these quantitative strategies with adaptive machine learning, enabling them to:

This hybrid approach will give traders a tool that not only automates but also thinks dynamically, much like a professional quant desk powered by AI.

Next-generation bots will move beyond price and volume metrics to harness alternative data sources, such as:

By fusing market microstructure data with global macro signals, AI bots could anticipate trends before they fully materialize.

Between 2025 and 2030, bots will extend beyond centralized exchanges into the DeFi ecosystem, managing liquidity in decentralized protocols, optimizing yield farming, and arbitraging between DeFi and CeFi markets.

Which is the best automated crypto trading platform?

Depends on user needs—Bitsgap for arbitrage, HaasOnline for advanced strategies, 3Commas for simplicity.

Furthermore, as tokenization grows, AI bots may trade across multiple asset classes simultaneously—cryptocurrencies, tokenized equities, synthetic commodities—creating a unified multi-asset automated strategy.

With greater power comes scrutiny. As AI bots gain influence, regulators will push for transparency in algorithmic trading. By 2030, we may see:

This means collaboration with a Crypto Trading Bot Development Company that prioritizes compliance and ethical AI will become a strategic advantage for businesses.

By the end of this decade, AI crypto trading bots will no longer be just “tools” for individual traders. Instead, they will evolve into intelligent market participants capable of:

This progression could blur the line between human and algorithmic trading, making hybrid AI systems a standard in the financial landscape.

In short: The future of automated crypto trading is not about replacing human traders, but about augmenting them with adaptive, intelligent systems. Traders and businesses that embrace this shift early—especially by partnering with specialists in AI-driven automation—will be best positioned to thrive in the fast-changing digital economy.

What is the best crypto trading bot for beginners?

Platforms like 3Commas and Kryll are beginner-friendly due to easy interfaces and prebuilt strategies.

How does an automated crypto trading bot work?

It connects to exchanges via API and executes predefined strategies automatically.

Is automated crypto trading profitable?

Yes, but profitability depends on strategy quality, risk management, and market conditions.

Are crypto trading bots safe and legal?

They are legal in most countries but not risk-free. Always verify providers and manage risks carefully.

A cryptocurrency trading bot can be a powerful tool for both beginners and professionals. While it offers speed, efficiency, and 24/7 trading, it should never be seen as a guaranteed path to wealth. Success depends on proper strategy, risk management, and continuous learning.